Humankind is rolling up its sleeves to receive vaccines that clinical trials showed are amazingly effective. The vaccine distribution process has started slower than hoped and infectious disease experts warn this will continue to be a difficult winter. As vaccination rates increase, infection rates will fall and our lives should start to return to normal. But not everything will be the same. The investment landscape has changed in many important ways. In this Investment Thoughts I will examine how the pandemic has changed the economy, market leadership and the behavior of consumers and companies. These changes are important because they influence how we are positioning your portfolios.

New Stage of the Business Cycle

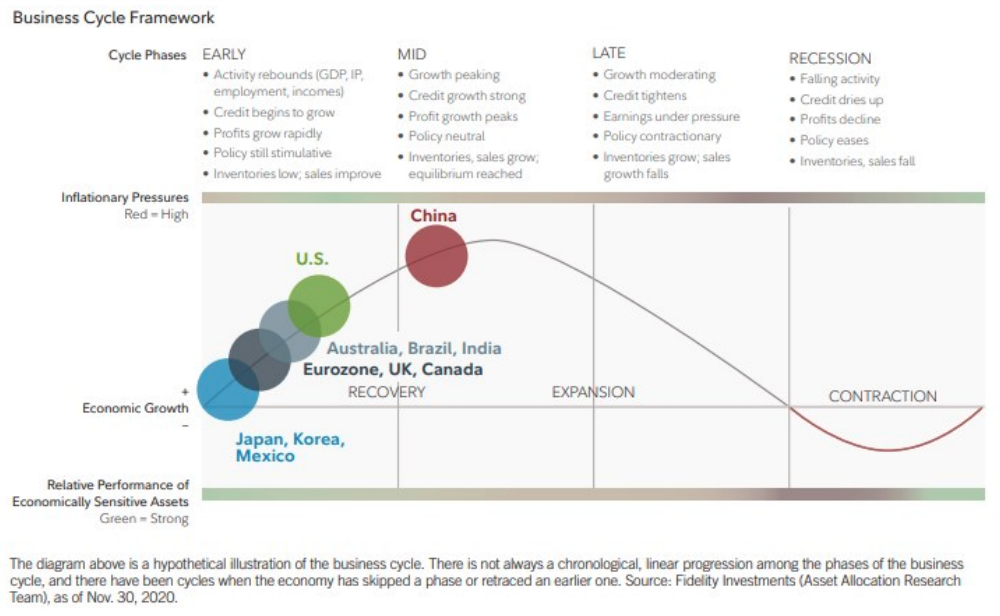

Last January we were fretting about the economic expansion which had become the longest in history. Expansions do not last forever and the late stage of the business cycle would inevitably give way to the next recession. Although we had taken steps to prepare, we did not know exactly how or when the cycle would end. The pandemic, of course, changed everything and plunged the world's economies into a deep recession. Fortunately, growth rebounded sharply during the third quarter of last year as lockdowns eased. But surging new coronavirus cases and restrictions have since thwarted a sustainable recovery. As 2021 progresses the broadening rollout of vaccines will allow economies to reopen. We are likely to see surge in consumer spending due to pent-up demand. Continued monetary and fiscal support will help fuel the rebound. Consequently, we believe most of the world's economies are entering the early stage of a new business cycle. The following diagram illustrates this.

Source: Fidelity Investments

Market Leadership is Changing

History shows that different investments perform well in each stage of the economic cycle. Late in the cycle, investors gravitate to a narrow set of companies that can grow their profits despite softer economic conditions. This is one reason the so-called Fab 5 stocks (Facebook, Apple, Amazon, Microsoft and Alphabet) performed so well. They appreciated by about 50% during the first 9 months of last year and became a quarter of the value of the S&P 500 Index. Investors bid up the price of these and other growth stocks because they could increase their revenues and profits at a time when overall economic growth was scarce. Many other companies were reporting losses. In October, these growth stocks started to underperform the market. This is not surprising; market leadership often changes during early-cycle recoveries. Investors rotated into much a broader set of companies that are more sensitive to economic conditions. These companies will likely experience a sharp rebound in earnings as economic growth picks up.

We have been adding to investments that do well in the early stage of the business cycle. Many of these investments lagged US large-cap growth stocks over the last decade and are attractively priced. We have increased exposure to international stocks using diversified funds. They are more cyclical than the US market because they hold more industrial, financial and materials stocks. Many value and dividend paying stocks also benefit from a stronger economic tailwind. We discussed why we like international and value stocks in our previous Investment Thoughts. You can read them on our website at LedyardBank.com/Insights.

Some Behaviors Will Change

The pandemic will alter some consumer and company behaviors permanently while others will revert to normal. We have spent time trying to understand these trends because they will affect the outlook for industries and companies. As we studied this, we found McKinsey & Company's framework to assess the stickiness of new behaviors quite helpful:

Stickiness = Forced Behavior (including duration) X Satisfaction

According to McKinsey's framework, the longer consumer behaviors are in place, the more likely they will persist. Studies show that it takes anywhere from 20 to 250 days to form a habit. The duration of most of our Covid-induced behaviors are now beyond that range. To endure, these new behaviors will also need to provide ongoing satisfaction after the pandemic. There are parallels to corporate decision making as well. We have applied this framework to several trends to decide which might persist.

E-commerce: Online shopping has been a lifeline for many of us during the pandemic. The health crisis forced even the most reluctant to place orders on the Internet for the first time. E-commerce sales surged 32% in 2020 and now account for 17% of total retail sales. This trend is likely to continue. Online shopping has become habitual and provides satisfaction because it is convenient. Companies that rely solely on bricks and mortar stores will continue to struggle. Those that offer superior technology and online user experiences will have an edge.

Remote working: During the pandemic many companies discovered that they can operate well with employees working from home. They can also save money on office space. In the future, many employees will like to work from home because they can skip the commute, focus on work projects and spend more time with their families. Because this trend is providing value to both employers and employees, it is likely to endure. This means that we will not need some of the 4 billion square feet of office space in the United States. This is positive for businesses that enable this trend by selling software and services such as highspeed broadband. While this trend has obvious benefits it also has some risks. Less time together in the office may reduce team cohesion and stifle creativity.

Virtual meetings: The pandemic forced us to use video technology because it was not safe to meet in person. While we are all tired of these meetings and eager to get together in person, we will continue to rely on this technology when it is convenient. Why not save a trip to the hospital when a telemedicine appointment for a minor ailment will do? Bill Gates believes 50% of business meetings will not be necessary in the future. This is negative for variety of industries including the airlines and related services.

Digital payments: The pandemic accelerated the use of digital payments. To be safe, consumers ordered more online and used less cash. Contactless payments are increasing. They allow you to pay by tapping. By year-end, Visa will have issued 300 million contactless cards accounting for one third their total. More than 80% of merchants now accept them. These and other digital payment trends will continue. They are beneficial for many banks, card issuers, processors and retailers.

Health and wellness: Elevated death rates among those with preexisting health issues reminded us that we should do what we can to stay healthy. The renewed focus on health, nutrition and strengthening our immune system will last. Drug makers built up a lot of goodwill and highlighted their capabilities by developing vaccines and therapies in record time. They will eventually face renewed criticism about high drug prices. But it will probably come later than it would have. This is positive for their near-term profitability and outlook.

We have also been putting a lot of thought into several long-term concerns that the pandemic exacerbated. Emergency measures to contain the virus and its fallout were necessary but expensive. As a result, government debt levels rose from already elevated levels. Debt service costs are currently manageable because interest rates are low. But rising debt could lead to higher interest rates, inflation and taxes. It could also crowd out spending on other priorities. Sadly, the multi-decade trend toward wealth inequality accelerated during the pandemic. If not addressed, it will put added strain on societies across the developed world and stifle economic growth.

We will be grappling with the aftermath of the pandemic for a long time. But with every crisis comes opportunity. As we have described, the pandemic's impact on the economy and consumer as well as business behaviors has provided us with new investment opportunities. This may also be an opportunity for humanity to address some significant lingering challenges. Events like this shake out our complacency and create a sense of urgency. They can inspire us to reflect, collaborate and innovate with renewed vigor. Let us hope that the pandemic fades quickly but leaves behind lasting resolve to move forward in a more cooperative and productive fashion.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.