Last year turned out to be an exceptional year for investors. The US equity market rose 30%. Even bonds generated returns in the high single digits. Many of our clients have asked why the markets were so strong given all the worrisome news about the slowing economy, trade war, quarrelsome politics and flat corporate earnings. They have also asked about future returns and how we plan to position portfolios for the coming decade. I would like to share our thoughts on these great questions.

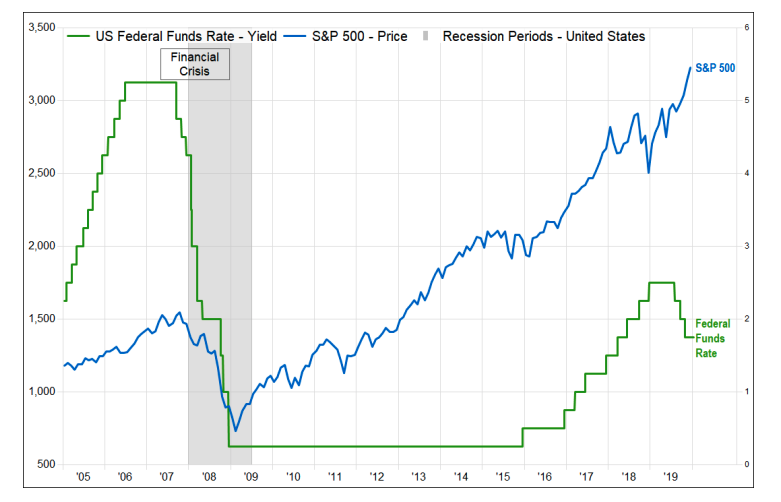

The Federal Reserve’s U-turn in monetary policy was the most important reason for last year’s strong returns. As the green line in the chart below shows, starting in late 2015, the Fed raised the federal funds rate nine times. The federal funds rate is the interest rate banks charge each other for overnight loans. When Fed Chair Jay Powell commented in October 2018 that the Fed was still “a long way from neutral,” investors panicked because they thought additional increases might cause a recession. The stock market, as shown by the blue line, fell almost 20% hitting its low on Christmas Eve. In 2019, the Fed reversed course and reduced rates three times. This pleased investors and the stock market rose sharply. Investors like lower interest rates because they stimulate the economy. They also make stocks appear more attractive relative to bonds.

By reducing interest rates, policy makers have abandoned their attempt to normalize monetary policy. Instead, they have returned to the same easy money playbook they have leaned on for more than a decade. Their dilemma is that although this is the longest economic expansion in history, it is one of the slowest. The cumulative increase in GDP has been a bit more than 20%. This is less than half the increases that occurred during the next two longest expansions that began in 1961 and 1991 respectively. As a result, the economy remains somewhat fragile and it does not take much to make it vulnerable. Tepid economic growth has resulted in weak wage growth, which has held many Americans back. Their fortunes stand in contrast to those that were lucky enough to have investment portfolios. These investors have benefited from the 250%+ rise in stock prices over the last 10 years. This divergence has contributed to the record wealth gap in our country and the rise in populism, two longterm risks. The good news is that this slow but elongated economic cycle has not resulted in many of the economic excesses that have marked the end of past cycles. This makes it unlikely that the Fed will raise rates in the near term, setting up financial conditions that may allow this cycle to continue to age gracefully.

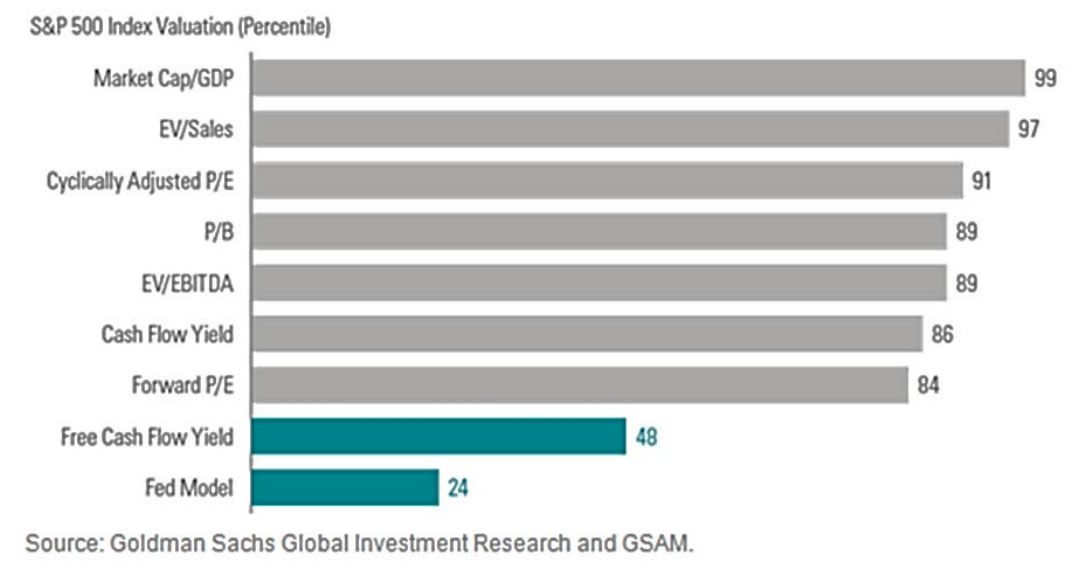

After an exceptionally strong decade, US capital markets are expensive by many measures. Current valuation levels tell us little about what the markets might do in the next year or two. They are, however, one of the most reliable predictors of expected returns over a 10-year horizon. They are sending a clear message that returns will likely be more modest in the decade ahead. As the following chart shows, seven of nine US stock market valuation ratios are near their 40-year highs. This suggests to us that single digit returns are more likely than the 13% annualized return we saw last decade. With interest rates near 30-year lows, bonds are likely to produce returns in the low single digits.

As we step into this new decade, we have rolled up our sleeves because we realize things will not be as easy as they were over the last 10 years. In an environment where many assets are expensive, we will have to work harder than ever to generate returns for our clients. With this end in mind, we have identified several themes that we expect to play out over the next decade. By aligning our clients’ portfolios with these themes, we hope to enhance returns and mitigate risk. We break them down into three categories: demand tailwinds, digital enablers and relative bargains.

Demand Tailwinds

Although economic growth is slow, secular trends will be a tailwind for demand in several areas and have a positive influence on certain investments.

Infrastructure Cannot Wait: The G20-backed Global Infrastructure Hub estimates the public and private sectors will need to spend $94 trillion by 2040 on infrastructure. These expenditures will cover necessities such as roads, bridges, rail lines, electricity generation, telecommunications and water supply facilities. They are necessary to meet the needs of a population that will increase by a quarter over that period. We need to improve our infrastructure in the US. The American Society of Civil Engineers gave it a D+ grade. Meanwhile, China has embarked on its Belt and Road Initiative. It is the most ambitious infrastructure project in history and involves as many as 150 other countries.

Millennials Step Up: The millennial generation, born between 1981 and 1996, has stepped up and has now overtaken the Baby Boomers as the largest adult population group. As they grow older, their spending power and influence will increase. We are seeking investments that are in-tune with their preferences. They include social media, healthy foods, access to rides and lodging rather than ownership and experiences over “things”.

Sustainability Soars: Sustainability is all about doing well by doing good. The demand for sustainable investment strategies has increased by over a third since 2016 to $30 trillion. We believe this trend will continue to gain altitude. Sustainability is one of many criteria we consider when selecting investments. For example, we consider the Environmental, Social and corporate Governance or “ESG” profile of our investments. We do so for two reasons. The demand for investments with strong ESG profiles will continue to be strong which should boost their market values. We also believe these companies may help us reduce risk. Management teams that focus on ESG tend to have a long-term orientation and take a more holistic view of the risks facing their businesses.

Digital Enablers

As Heraclitus said, “The only thing that is constant is change.” Leadership in the market changes each decade as disruptive trends alter the playing field. The winners will be companies that embrace change and create or use technology to gain a competitive advantage. Here are two examples:

Manufacturing: Brains over Brawn: Low cost producers from abroad disrupted the US manufacturing sector a long time ago. While this sector may never regain its relative brawn, manufacturers will continue to get smarter. There is significant opportunity investing in companies that use technology to improve the quality of their goods, shorten design time and reduce waste. Technologies such as robotics, 3D printing, the Internet of Things and artificial intelligence will help many companies succeed.

Digitization of Healthcare: The United States spends two and a half times more on healthcare per capita than the average OECD country. However, life expectancy is lower. This needs to change. A key to improvement is the anticipated shift toward “value-based reimbursement.” It pays providers for successful outcomes rather than by the number of procedures completed. Companies that develop or use technology to produce better outcomes and improve productivity will do best in this new paradigm. There are many examples of this. Tools for gene sequencing will lead to a new era of personalized medicine. Robotic surgery will result in smaller incisions, less discomfort and shorter hospital stays. Digital record keeping will allow doctors to manage their offices more effectively.

Relative Bargains

Some segments of the world’s equity markets are less expensive than others. Because lower valuations often result in higher returns for patient investors, we believe it will be helpful to invest in these relative bargains.

Opportunity Knocks Abroad: The performance of US and international stocks is cyclical. One outperforms the other for several years until the cycle reverses. The US market’s performance has trounced that of international markets for almost a decade. This is the longest winning streak in history. As a result, international markets are trading at wide valuation discounts relative to the US market. The price-to-earnings ratio of the emerging markets is 30% less than that of the US despite their higher growth prospects. The average European stock has a dividend yield over 4%, about double that of the US market. Although international valuations may never match those in the US, the unusually wide gap will likely narrow in the coming decade.

Value Investing Returns from the Brink: Value investors seek stocks trading at a discount to their estimate of “intrinsic” value based on an assessment of their fundamentals. This is a fancy way of saying they buy stocks when they are on sale like many shrewd shoppers do. Famous investors such as Warren Buffett practice this style of investing. Although value investing has produced strong results over time, returns have lagged the market by a wide margin over the last decade. As a result, cheap stocks are even cheaper than usual. In fact, they have not been this inexpensive relative to the market since 2000 when the dotcom bubble peaked. Value stocks subsequently significantly outperformed the market for five years. Although it may still be too early for a rotation back into value stocks, we are confident this style of investing will return from the brink, as it has in the past. This will result in a multi-year period of outperformance.

Over the next decade, our investment team will continue to look for opportunities like these to boost your returns. I would be remiss if I did not point out that your success will require a concerted effort. In a lower return environment, our team’s approach to providing integrated and customized advice will be more important than ever. It will be a time to mind the details and pull as many levers as possible to help you plan well so you can live well. As I mentioned, we have rolled up our sleeves and are up to the challenge. Please stay in close contact with us. If there are changes in your life that may affect your financial circumstances, please let us know so that we can factor them into your plan and make adjustments if necessary.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.