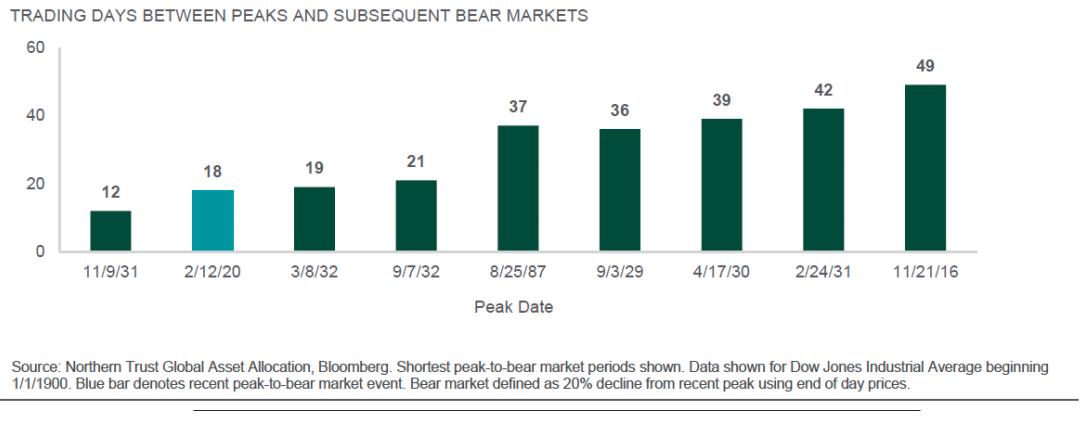

The world’s stock markets have declined sharply as investors have wrestled with the uncertainty surrounding the spreading COVID‐19 (coronavirus). The surprise oil price war between Saudi Arabia and Russia has caused the second largest drop in oil prices in history. This has added to anxiety levels. As the chart below shows, the stock market fell 20% in 18 days. This was the second fastest bear market to develop in history. Investors are understandably nervous about the markets, their own physical health and the health of their loved ones. We are committed to helping our clients navigate through this challenging environment. To that end, we would like to share some thoughts with you on developments that occurred since our last note on March 11th.

In the past, the markets have recovered from epidemics quickly. The COVID‐19 outbreak, now a pandemic, has become more complicated. Social distancing is being implemented across the country to slow the spread. Businesses, schools and major events have shut down. This is akin to shifting the economy from moderate highway speed to low gear. It ensures that economic metrics will slow significantly in second quarter. Weakness will probably last into the third quarter and lead to a recession (defined as two consecutive quarters of negative growth).

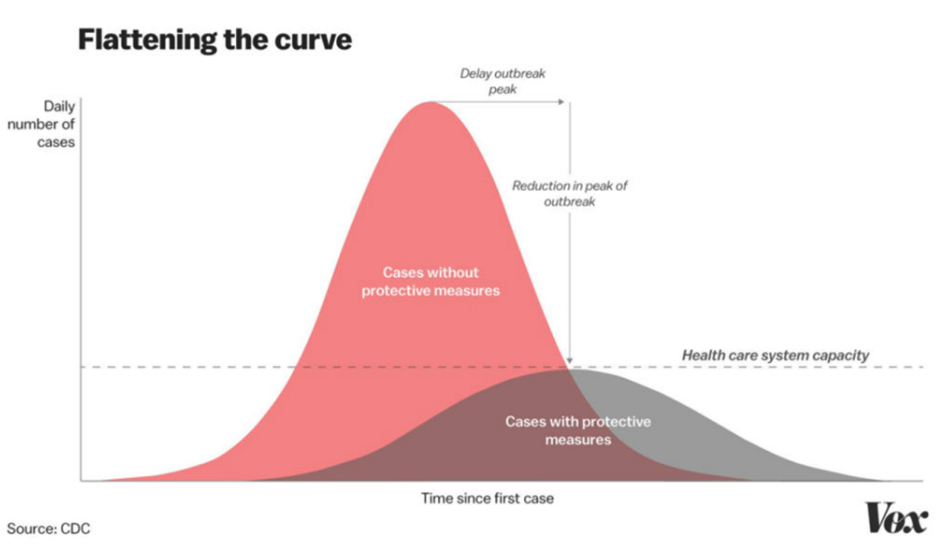

The length and depth of the contraction in economic activity will depend on how long it takes for the coronavirus to peak and subside. The good news is that the containment and mitigation efforts appear to have been successful in China (including Hong Kong), South Korea and Singapore. China reports that 90% of their state owned enterprises have resumed work. Apple and Starbucks have now reopened most of their stores in China. New coronavirus cases peaked and receded in China and South Korea in a period of about eight weeks. While I am optimistic that the coronavirus will pass in the US, it will likely take longer. The US was slower to act. As a democratic nation, it is harder to lock down entire cities as China did. Unlike South Korea, we did not have enough testing kits available in the early days. As shown below, the goal is to flatten the curve and slow the growth rate of the virus so that it will not overwhelm our healthcare system. If we are successful, the mortality rate will be lower because doctors will be able to provide better care to the most serious cases. It will also mean that we have to practice social distancing longer which will delay the economic recovery.

Government policy initiatives will not cure the coronavirus but are essential to mitigate its effects. The Federal Reserve has thrown everything but the kitchen sink, and then the kitchen sink, at this problem. They made two emergency cuts to the Fed Funds rate, bringing it to zero. They have also taken steps to add a significant amount of liquidity to the markets. This is necessary because liquidity conditions have been poor which has amplified volatility and created stress in the plumbing of the financial markets.

This is partly an unintended consequence of post‐financial crisis regulation to shore up the banks. Bank traders are now less willing and able to hold inventories of securities and take the other side of trades.

Fiscal policy (government spending and tax cuts) will help reduce the fallout by providing businesses and consumers with financial relief. Congress is considering a third stimulus bill of more than $1 trillion, which represents about 5% of annual GDP. Divided politics may slow passage of this bill. We hope this will not be the case as neither party will want to appear to be obstructionist during such a difficult period. This package will likely include sending money directly to Americans. This will be necessary as the unemployment rate will increase. Workers in parts of the service sector such as local restaurants and independent workers in the “gig economy,” such as Uber drivers, are most at risk as they often live paycheck‐to‐paycheck. Many do not have savings and will need to pay their rent and cover other living expenses. Fiscal policy will also provide help to certain industries impacted by the coronavirus such as the airlines.

During market declines such as this, investors are always tempted to sell stocks. Given the negative headlines, this may seem like a reasonable decision. Unfortunately, selling after such a sharp decline often backfires. The markets are a discounting mechanism. As such, they are already discounting a lot of bad news that is expected in the future. The markets were quick to discount the negative economic implications of the spreading coronavirus. They may be quick to sniff out the recovery when it comes.

I started in the investment management business a year before the crash of 1987. The market declined 22% in one day. I remember the horror of that “Black Monday,” how fear gripped investors and led to myopic thinking. Some could not visualize a better future and opted to get out and wait for things to settle down. They missed the recovery which came quickly and they struggled to get reinvested. Timing the market is extremely difficult. The investors that fared the best were those who remained disciplined and focused on their long‐term objectives. This lesson has stuck with me to this day. I have lived through over fifteen market crises and/or crashes of varying magnitudes since. I have observed time and time again that maintaining a disciplined approach is what matters most. Since that frightful day in 1987, the S&P 500 Index increased from 250 to 2,400 ‐‐ and that does not include all the dividends paid to investors over that 33 year period!

Your investment team at Ledyard has been busy. As we grind through this challenging environment, we remain focused on the fundamentals of our investments. We are taking advantage of market weakness to upgrade portfolios. We are buying stock in companies with sustainable business models, smart management and strong balance sheets. These companies are in a position to take advantage of the weaker environment to improve their competitive position. This will help them thrive in the long run. We have had many conference calls with our network of strategists and fund managers throughout the country. Our conversations have focused on a broad range of topics including the bond market which has also experienced considerable volatility. We have even spoken to the firm that manages our money market funds. We will continue to be vigilant and work hard for you.

In today’s connected world, it is harder than ever to look beyond the negative headlines and maintain perspective. But brighter days will come, and this too shall pass. The coronavirus will impact all Americans regardless of wealth, race or political beliefs. We are all in this together. Let’s hope there is a return to normalcy sooner than later and perhaps even a silver lining. This event may be the crucible moment that is necessary to bring us together so we can emerge as a more united Nation.

Please do not hesitate to contact us if you have any questions or would like to discuss your portfolios in more detail.

Douglas B. Phillips, CFA

Douglas B. Phillips, CFA

Chief Investment Officer

douglas.phillips@ledyardbank.com

This communication is intended to be strictly informational. Exclusive of our client relationships, it is not intended to be, nor does it constitute an offer to sell or a solicitation of an offer to buy any securities referenced. Information contained herein has been obtained from sources that are believed to be reliable, but its accuracy and completeness cannot be warranted or guaranteed.

Non-deposit investment products are not insured by the FDIC, are not deposit or other obligations of, or guaranteed by the bank or any affiliate, and are subject to investment risk including the possible loss of principle amount invested.

Ledyard National Bank. All rights reserved.